Term Life Insurance

MyTerm Plus Term Life Insurance Plan

Double 1+1 Best Deal 2024! Add-on offer up to 90% off first-year premium on 2nd policy!

I am applying for

Gender

Smoking status

Age

Renewable period

Choose a plan

Monthly

Annual

Have a promo code?

All premiums are calculated on standard rates and this quote is for reference only. The actual premium to be paid includes an insurance levy, which we’re obliged to collect for the Insurance Authority.

Before proceeding, please confirm you understand this product’s features and that it fits your need(s).

Why needs MyTerm Plus?

MyTerm Plus is a pure term life insurance. When misfortune occurs and you can no longer be with your family in person, MyTerm Plus will provide them with a lump sum of financial support, as if the last "gift" you leave to your loved ones.

MyTerm Plus offers “10 out of 10” coverage!

- Total amount payable up to HK$24 million1. No.12 online term life insurance coverage

- MyTerm Plus Term Life is rated 10 out of 10 by the online insurance comparison platform, 10Life, an expert-recommended term life product3

given your family any memorable gift?

Bought my parents a massager with my first salary after entering the workforce to repay for raising me

Bought my other half the most-wanted watch on the wedding anniversary to make him/her happy

Took my children on a trip to Japan, to the theme park they like, and eat their favorite ramen and sushi when they excelled in the exams

how can MyTerm Plus, this gift be enough for the whole family?

To safeguard against the lost of household support from children, and help your parents continue enjoying the retirement

To protect against the risk of mortgage default, and help your other half continuing paying for your home

To minimize impact of your children’s education plans, allowing them to pursue their dreams as they wish

FWD can help you! Life coverage of up to HK$24 million1

What’s special about MyTerm Plus?

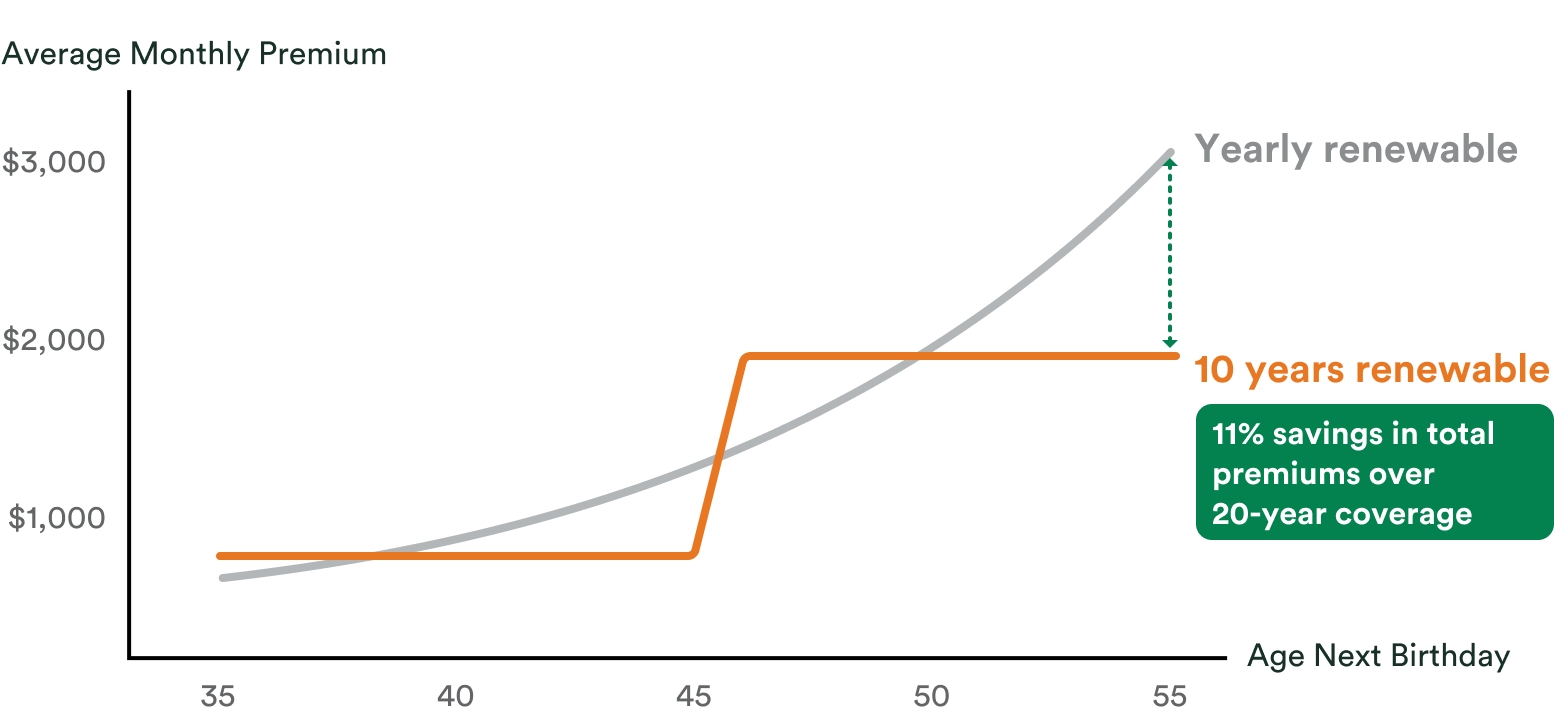

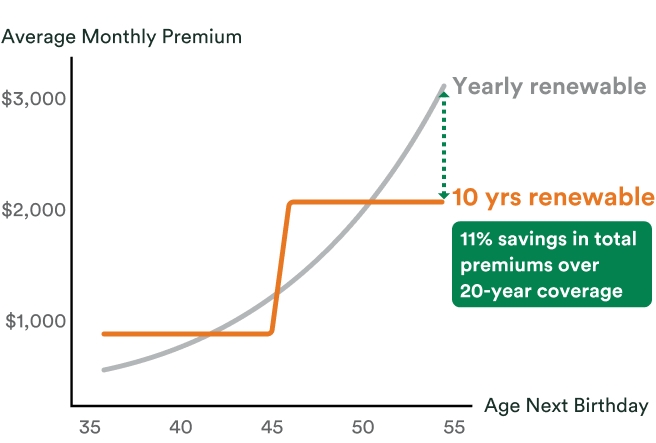

Flexible renewable period. 10 years renewable period allows you to plan ahead on your expenses

Yearly renewable: enjoy comparatively lower premiums at application;

10 years renewable: avoid the risk of premium increases and plan ahead for the long-term expenses.

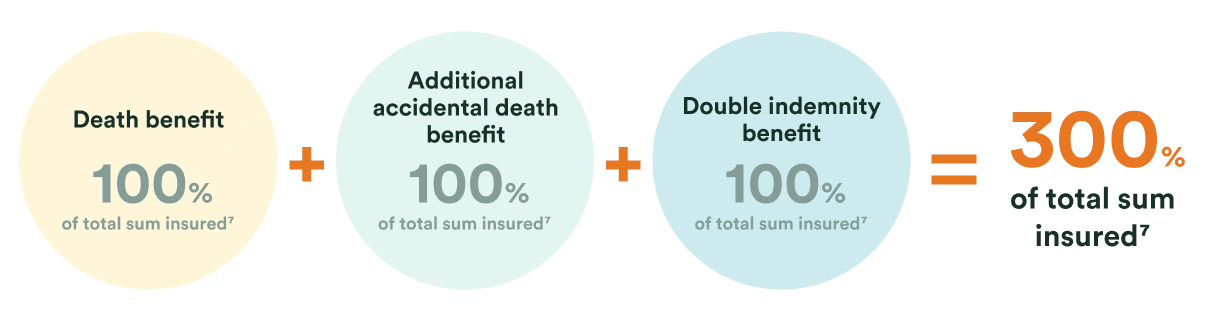

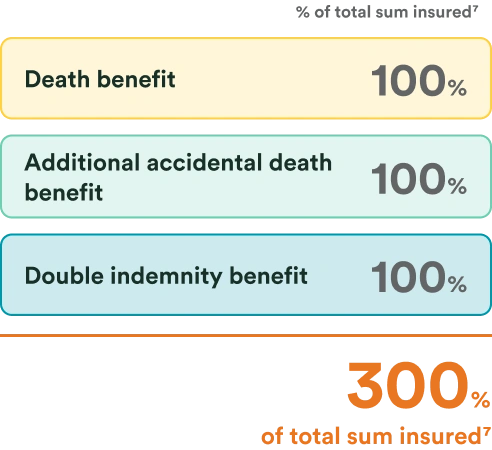

Total amount payable = 300% of total sum insured

The total amount payable of the same type of term life insurance in the market is 100% of the total sum insured. MyTerm Plus (Superior) can offer life + accidental benefits up to a total amount payable of HK$ 24 million1 (=300% of total sum insured)!

Comparison of Term life

An example of HK$8 million sum insured

| FWD MyTerm Plus Superior version8 | B Company | Company B | |

|---|---|---|---|

|

Max. sum insured

(Age Next Birthday) | HK$8million⁹ (19-51) | HK$8million (19-46) | HK$5.5million (19-56) |

| Comparison of total amount payable | |||

| Max. total amount payable | HK$24million¹ 300% of total sum insured | HK$8million Only 100% of total sum insured payout under any scenario | HK$5.5million Only 100% of total sum insured payout under any scenario |

| Scenario 1 Insured passes away due to sickness | HK$8million Death Benefit | ||

| Scenario 2 Insured passes away due to an accident |

HK$8million x2

Death Benefit

Additional accidental death benefit

| HK$8million 100% of total sum insured | HK$5.5million 100% of total sum insured |

| Scenario 3 Insured passes away due to an earthquake during travelling |

HK$8million x3

Death Benefit

Additional accidental death benefit

Double indemnity benefit

| ||

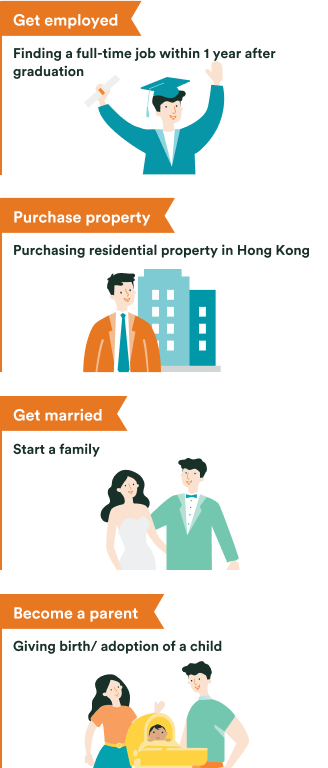

Uplift of sum insured at ease without underwriting for the designated important milestones

For each important milestone in life, you deserve an extra “gift”!

At the designated important milestone in life, you can uplift the sum insured at ease without underwriting10, so you can protect your family more!

Uninterrupted coverage during unemployment

If a worker becomes unemployed, he/she may not be able to pay the premium temporarily, and it may lead to lapse in coverage.

MyTerm Plus can help you! 1 year premium wavier for unemployment!

Still think MyTerm Plus is not your choice?

If you are…

Super rich

No need to worry for any expenses!

Selfish people

Do not care about your family expenses!

If you are not one of the above, MyTerm Plus can help you! Just a small amount of premium can cover your family’s expenses in the future!

How much sum insured is enough for protecting your family?

is planning to buy more life protection for himself, but he does not know how much coverage is enough

(25 years more from now)

| Amount required for protection | |

|---|---|

| Annual income | HK$480k (Monthly income x 12 months) |

| Working period until the expected age for retirement | x 25 years |

| Total | HK$12 million |

FWD can help you! Life coverage of up to HK$24 million1

Choose your ideal plan option

Economy Standard | High CP value Superior | |

Death benefit | ||

Advanced death benefit11 | ||

Additional accidental death benefit12 | ||

Double indemnity benefit | ||

Life Celebration Booster Option13 | ||

Unemployment premium waiver benefit14 | ||

Conversion privilege15 | ||

FWD Care - Second medical opinion service16 | ||

Monthly Premium | as low as HK$9.72 Quote now | as low as HK$11.52 Quote now |

The premium is calculated on standard rates and is based on the monthly premium for a non-smoking male aged 18 with coverage of HK$200,000 at a renewal term of 1 year. All premiums (exclude levy collected by the Insurance Authority and non-guaranteed) are rounded to the nearest whole number and the actual premium amount varies from person to person and is for reference only.

How good is FWD Online?

FWD Online - A one-stop insurance platform

Customers are asked as little as 1 health question with no medical exams or certificates.

Just a few taps and you can complete your online application as quickly as 5 minutes

Most customers can be covered with their policy emailed back as quickly as 30 minutes.

We make it easy to claim - and even easier to get paid. Selected claim types are approved and paid in just 42 seconds.

Voice of real customers

Good variety of product! Very convenient!

The online platform is easy to use with clear instructions.

MyTerm Plus at-a-glance

Basic Plan

19 – 66

To insured’s age17 100

Guaranteed renewable up to insured’s age17 100

yearly / 10 years

- Premium is varied by factors including but not limited to insured’s age17, gender, smoking habit, usual residency, occupation, health factors and renewable period5

- For 10 years renewable period, the premium rate18 is guaranteed and will not be increased based on the age17 of the insured within each of the renewable period5

- MyTerm Plus will be renewed at the end of each renewable period5. The premium rates upon renewal are not guaranteed and will be determined at our sole discretion based on factors including but not limited to the age17 of the insured at the time of renewal, claims experience and policy persistency from all policies under this product

HK$

HK$200,000

| Issue age17 | Maximum sum insured |

|---|---|

| 19 -51 | HK$8,000,000 |

| 52 – 66 | HK$3,500,000 |

This platform offers Monthly / Annual premium payment mode

Policy holder can contact FWD Customer Service to amend premium payment mode after policy is effective

MyTerm Plus is underwritten by FWD Life Insurance Company (Bermuda) Limited (incorporated in Bermuda with limited liability) ("FWD Life/ FWD/We"). This eCommerce Platform is operated by FWD Financial Limited ("FWD Financial"). FWD Financial is an appointed and licensed insurance agency of FWD Life.

The product information in this website is for reference only and does not contain the full terms and conditions, key product risks and full list of exclusions of the policy. For the details of benefits and key product risks, please refer to the product brochure; and for exact terms and conditions and the full list of exclusions, please refer to the policy provisions of the plan.

Please make sure you are eligible for this product before applying:

• I (and the Insured person if applicable) am a permanent HKID card holder with a Hong Kong residential address.

• Currently in Hong Kong at the time of making this application.

• I will not or have no intention to live or work outside Hong Kong or home country over 183 days in the coming 12 months.

• I am not a holder of the People’s Republic of China Resident Identity Card.

Note: Online applicants will be requested to visit FWD Insurance Solutions Centres under the following circumstances: 1) Collection of policy documents upon issuance of policy; 2) Cancellation of policy during the cooling-off period; 3) Change of beneficiary; or 4) Full surrender. Under specific circumstances, we may request online applicants to visit FWD Insurance Solutions Centres for identity verification.

Not exactly what you need?

If you are looking for a product that offers broader benefit coverage and higher benefit limits. Please contact us for more information.

.svg%3Fformat%3Dwebp&w=3840&q=75)