Achieving success is a great way to simplify life. It makes it unnecessary to consider any alternatives to the very best of everything. This advantage is especially essential when it comes to the one area where no compromise should ever be accepted - your health.

vTheOne Medical Plan (“the Plan”), certified by the Government, offers prestige medical benefits with an aim to provide coverage for a comprehensive treatment and recovery journey for you. vTheOne Medical Plan is a Flexi Plan certified by the Hong Kong Special Administrative Region Government under the Voluntary Health Insurance Scheme (“VHIS”) and is underwritten by FWD Life Insurance Company (Bermuda) Limited (incorporated in Bermuda with limited liability).

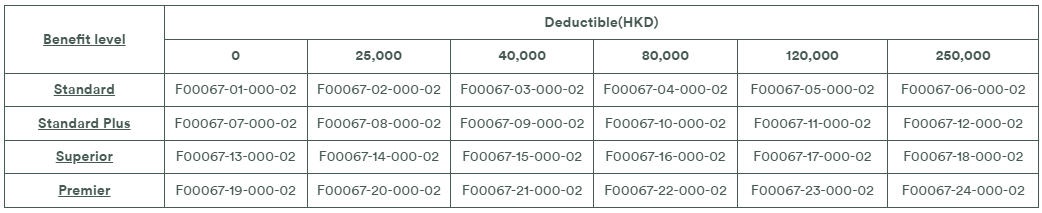

VHIS Plan Certification Number:

VHIS provider registration number is 00036

Registration effective on 28 February 2019

The plan provides a full cover² on medical expense incurred for a series of hospitalisation and surgery in Standard Private Room, with Annual Benefit Limit and additional Annual Benefit Limit on medical expense incurred within Greater China³ (if applicable), and without Lifetime Benefit Limit. The Plan also provides flexible choices of geographical coverage for non-Emergency Treatment such as Asia⁴ (for Standard and Standard Plus benefit levels), Worldwide excluding the United States of America (“USA”) (for Superior benefit level) and Worldwide (for Premier benefit level); and without geographical limitation for Emergency Treatment.

The plan provides full cover² on a wide range of medical expenses, including Prescribed Non-surgical Cancer Treatments⁵, kidney dialysis⁶ (including the rental cost of a kidney dialysis machine for use at home) and organ or bone marrow transplantation. On top of the respective aggregate limit per Policy Year, you are entitled to an additional benefit limit for these three kinds of treatments of up to HKD1,500,000 per Policy Year (for Standard and Standard Plus benefit levels), HKD2,000,000 per Policy Year (for Superior benefit level) or HKD2,500,000 per Policy Year (for Premier benefit level), which further eases your burden throughout your treatment journey.

To enable you to receive advanced and suitable treatment, we therefore extend the coverage for cancer treatments with:

- an additional benefit limit for Prescribed Non-surgical Cancer Treatments⁵ on top of the Annual Benefit Limit;

- Phase 3 Clinical Trial Drugs benefit for Stage III and Stage IV Specified Cancers and incurable haematological malignancy⁶ covering treatment with Phase 3 Clinical Trial Drug up to a designated benefit limit; and

- First in VHIS market⁷: FWD x HKSH Medical Group (“HKSH”) — Cross-border Cancer Management Program8,9.

- Cash benefit for Day Case Procedure (First-in-VHIS-market⁷: Cash benefit will be doubled up if the Insured Person receives designated Day Case Procedures at a Designated Healthcare Services Provider10 or a Day Case Procedure at a Hospital as stated in the designated Hospital list in mainland China)

- First-in-VHIS-market⁷ : Cash benefit for major and complex surgeries. You need to undergo a surgical procedure which is categorized as major or complex according to the Schedule of Surgical Procedures or as reasonably determined by us if the surgical procedure is not included in the Schedule of Surgical Procedures; or

- First-in-VHIS-market⁷: Cash benefit for Confinement in Intensive Care Unit in Hong Kong: You have been confined in Intensive Care Unit for at least 3 consecutive days in Hong Kong.

- Reimburse for a list of home facility enhancement⁶ prescribed by occupational therapists

- Stroke ancillary benefit⁶ covers charges on consultations and treatments prescribed by Specialists and Chinese medicine practitioners

- Provides the Disability subsidy benefit of HKD12,000 per month and up to 24 months per Incident per month.

The Plan provides 6 Deductible¹ options (HKD 0/ HKD 25,000/ HKD 40,000/ HKD 80,000/ HKD 120,000/ HKD 250,000) and 3 different geographical areas for you to choose, that allow the flexibility of the Deductible¹ for medical treatment and geographical coverage. In addition. When your policy has been in-force for at least 2 consecutive years, you will be entitled to the right to reduce or remove your Deductible¹ once per lifetime, or enjoy our first-in-VHIS-market⁷ feature, exercising the one-off right to upgrade your benefit level⁸ once per life when you reach the Age of 50, 55, 60, 65, 70, 75 or 80 (attained age) without providing further proof of your health condition.

If you are ever diagnosed with a designated crisis11, the Deductible1 (if any) will be waived1,6,11.

If you haven’t made any claim for 2 or more consecutive policy years before renewal12, the Plan will offer you no claims premium discount13 on your next renewal12 premium. Besides, any benefits paid under relevant benefits items for any designated Day Case Procedure(s) performed at any Designated Healthcare Services Providers10, which are performed on the Insured Person during the no claims period, shall not affect the eligibility for no claims premium discount13. You may enjoy individual and extra no claims premium discount13 of up to 25% by getting insured with your family.

If your Policy has been in force for 2 consecutive Policy Years, your baby will be born into the protection of a designated medical plan, effective for two years without further evidence of insurability and at no additional charge8,14. This benefit applies to each newborn once only, but there is no limit to the number of eligible newborns.

One stop health solution8

- PREMIER THE ONEcierge for exclusive healthcare solutions with cashless facility tailor-made to suit your needs;

- Second Medical Opinions provided by some of the highest-ranked US medical institutions;

- International SOS 24-hour Worldwide Assistance Service ensuring that help is always just a call away;

- MINDcierge offering a referral service program for any mental health issue and child development;

Mainland China-focused services8

- International VIP Access accelerating your access to medical services by offering priority booking service at over 300 Grade 3A hospitals in mainland China;

- Exclusive medical companion services for the designated hospitals with International VIP Access in mainland China to assist you in hospital admission registration;

- Cashless facility for hospitalization at all Grade 3A hospitals in mainland China;

- Mainland China Emotional Counselling Service supporting your emotional wellness with 6 free counselling consultations annually in mainland China either through phone call or face to face;

- Elderly Care Services provided to you upon diagnosis of designated 68 major crises in mainland China;

Elderly supporting services8

- Dementia Support Program offering a designated support program to the Insured Person or a referral service for a designated support program to the parents of Insured Person upon the Insured Person’s or the parents of Insured Person's First Confirmed Diagnosis of Alzheimer’s Disease; and

- Holistic Elderly Home Care Services8 provided to you upon First Confirmed Diagnosis of Alzheimer’s Disease or Parkinson’s Disease after designated age.

Prevention is always better than cure, to encourage you to have a stay healthy, the Plan offers you the wellness joy benefit15 for reimbursing the expenses on wellness activity(ies) including travel, fitness / wellness course, health check-up, child development assessment or training therapy.

- Guaranteed renewable12 up to age 100 (attained age)

- Any illness, Disease or Congenital Condition that was an unknown Pre-existing Condition at the time of Application will be fully covered by the Plan starting from the 31st day of the first Policy Year.

- You may be eligible for tax deduction of up to HKD8,00016 per Insured Person per year of assessment for premium you paid.

Do you know what factors FWD considers when handling medical claims?

Click this link to find out more about claims tips.

Eligible customers can migrate their existing designated FWD individual indemnity hospital insurance plan to designated FWD certified plans under Voluntary Health Insurance Scheme.

Save smart, pick smarter!

Comparison between the benefit items of our VHIS plans

Whenever you need information or assistance, FWD professional health assistance services, including PREMIER THE ONEcierge one team health management, MINDcierge, second medical opinion services, international SOS 24-hour worldwide assistance services and mainland China focus – Mainland China Home Care Services are always here to help.

Cooperating with New Frontier’s Guangzhou United Family Hospital and Shenzhen New Frontier United Family Hospital, the pioneer Cross-border Medical Services at the Greater Bay Area is launched to endeavor a more efficient and comprehensive medical service for eligible customers.

FWD partners with EC Healthcare to launch a diversity of health assistance services, endeavouring to change the way people feel about insurance from prevention and wellness, treatment to recovery.

FWD integrates digital elements into FWD Care and launches a network doctor eBooking function for individual medical insurance on FWD eServices, a one-stop, 24/7 policy service hub. Eligible customers can now make an appointment anytime, anywhere for the following services, including:

- Designated day surgeries performed in Hong Kong and cashless facility (including outpatient colonoscopy and gastroscopy service, cataract surgery and wart treatment)

- Hong Kong doctor’s referral and cashless facility

- Mainland China VIP hospitals network appointment and accompanying services

Network doctor eBooking function is now available on FWD eServices, allowing you to access the eBooking platform of our partner anytime, anywhere to book for services needed, such as designated day surgeries and cashless facility, doctor referral service, and Mainland China VIP hospitals network appointment and accompanying services.

The eBooking function is user-friendly and convenient. Check out the video now to learn more!

Efficient and seamless claims resolution cashless facility for outpatient colonoscopy and gastroscopy service, cataract surgery and wart treatment in designated network specialist day surgery centres

Apart from contacting HealthMutual Group by phone or via WhatsApp or WeChat to make an appointment, with the help from a financial advisor, you can instantly make an appointment and apply for the efficient and seamless claims resolution and cashless facility for outpatient colonoscopy, gastroscopy, cataract surgery and wart treatment in designated network specialist medical service centres

FWD partners with HKSH medical group to make available a pioneering cancer and rehabilitation planning consultation service to FWD customers of designated insurance plans in the event of a cancer diagnosis.

Helpful notes

The product information in this website is for reference only and does not contain the full terms and conditions, key product risks and full list of exclusions of the policy. For the details of benefits and key product risks, please refer to the product brochure; and for exact terms and conditions and the full list of exclusions, please refer to the policy provisions of the plan.

FWD professional health assistance services and other ancillary services are provided by a third-party service provider. Terms and conditions apply. FWD makes no representation, warranty or undertaking as to the availability and quality of the service. FWD shall not accept any responsibility or liability for their services, opinions, treatment, negligence, omission or failure to act by such third-party service providers. FWD reserves the right to replace any of such service provider or cease and/or suspend the provision of such services without prior notice. This service is optional. The provision of such service and your acceptance of the same shall constitute a separate contract between you and the third party service provider and does not form part of the Terms and Benefits of vTheOne Medical Plan. FWD does not provide any medical advice and you should consult your own medical advisors for professional advice.

This promotion material is intended to be distributed in the Hong Kong Special Administrative Region only and shall not be construed as an offer to sell, a solicitation to buy or the provision of any insurance products of FWD Life outside the Hong Kong Special Administrative Region. All selling and application procedures of the promotion must be conducted and completed in the Hong Kong Special Administrative Region.

This product is underwritten by FWD Life Insurance Company (Bermuda) Limited, a company incorporated in Bermuda with limited liability ("FWD Life/ FWD"). FWD Financial Limited is an appointed and licensed insurance agency of FWD Life. (License No. FA2568) Please consider replacing with the following:-

FWD professional health assistance services and other ancillary services are provided by a third-party service provider. Terms and conditions apply. FWD makes no representation, warranty or undertaking as to the availability and quality of the service. FWD shall not accept any responsibility or liability for their services, opinions, treatment, negligence, omission or failure to act by such third-party service providers. FWD reserves the right to replace any of such service provider or cease and/or suspend the provision of such services without prior notice. This service is optional. The provision of such service and your acceptance of the same shall constitute a separate contract between you and the third party service provider and does not form part of the Terms and Benefits of [name of the insurance plan]. FWD does not provide any medical advice and you should consult your own medical advisors for professional advice.

.svg?format=webp)